A number of months ago I was out on a run in the woods near my house. I was listening to episode 1,560 of This Week in Startups in which the host, Jason Calacanis, was explaining the seven different ways wealth gets created.

As I ran I was increasingly fascinated. With each step through the forest, Jason brought a level of clarity to the financial ecosystem, filling in gaps in my knowledge.

Why this matters

As a follower of Jesus, I believe that its important to keep the right perspective on money. Money is important and a valuable tool, but when it’s in the wrong place, it can be excedingly destructive. It’s no wonder Jesus says implies that money is the greatest threat we have to following God.

Given the proclivity for us to put our hope in money (and if you’re like me, this is a bigger threat when I’m focused and talking about money a lot) framing this topic through the lens of Jesus’ words on God’s provision is important.

So do not worry, saying, ‘What shall we eat?’ or ‘What shall we drink?’ or ‘What shall we wear?’ For the pagans run after all these things, and your heavenly Father knows that you need them. But seek first his kingdom and his righteousness, and all these things will be given to you as well. (Matthew 6:31-33)

With that acknowledged, knowing how money is accumulated can help us make better sense of the world around us and when used well can create greater impact for good.

The different methods of wealth creation

There are seven ways that wealth gets created. All money that comes into your bank account is generated in one of these ways.

(This doesn’t include investment tools like stocks/bonds/CDs/etc. These tend to be more wealth “growth” tools rather than weath “generation” tools and are better suited to be addressed separately.)

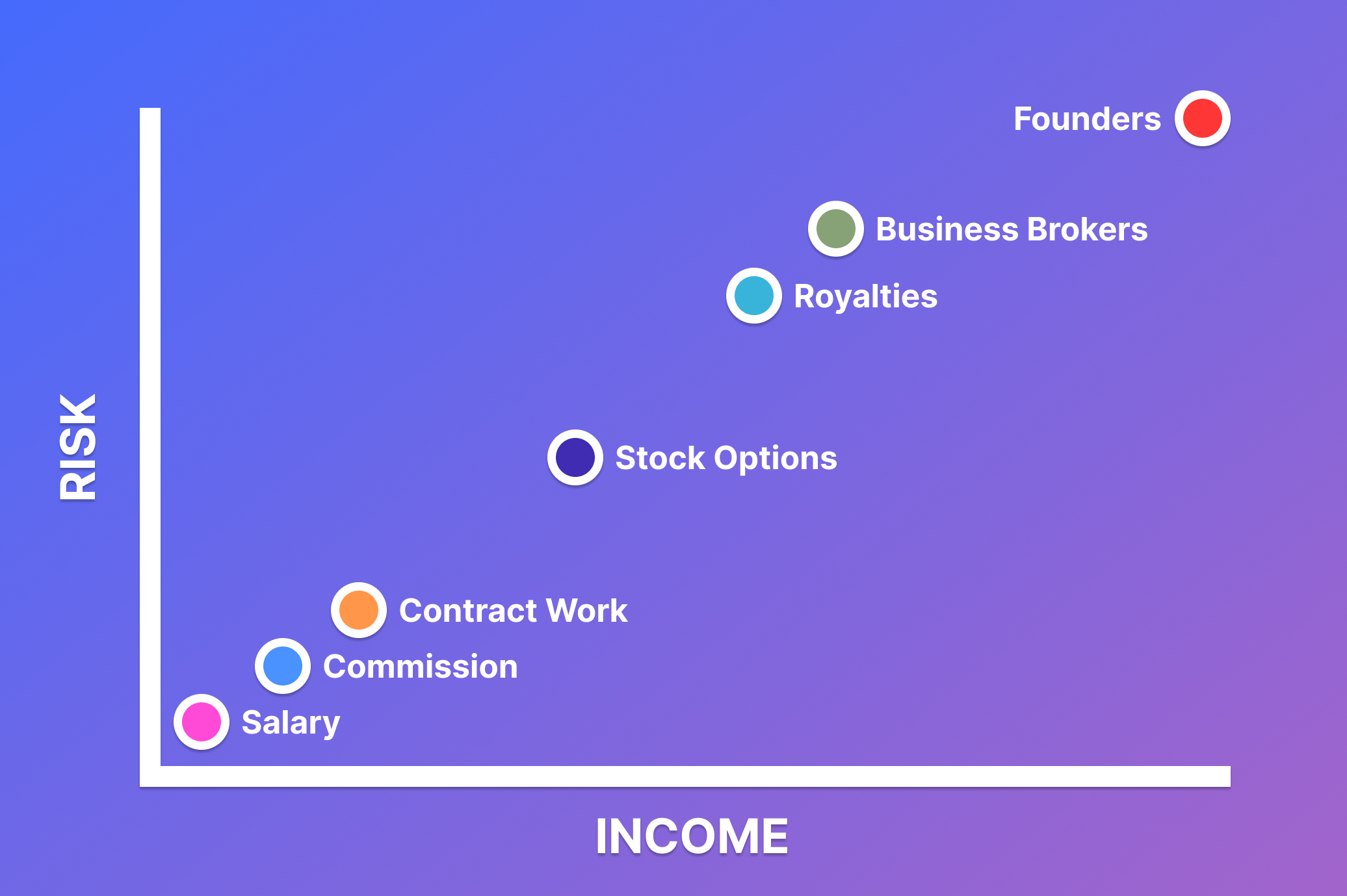

The seven methods are placed on a risk/income graph that shows how the riskier the strategy, the more potential upside exists.

1. Hourly/Salary ($40k/year - $200k/year)

In the bottom-left of the graph we have hourly/salary. This is how the vast majority of people make their money. They go to work and in exchange for showing up, they get a gaurunteed amount of money, either for each hour they work or for the year.

There’s not a lot of risk involved for the employee. Sure, they could get fired, but even then there are labor laws that are helping ensure this downside is minimized.

For someone fresh out of college, stepping into an entry-level position in sales or marketing, they might be making $50,000 or $60,000 per year.

As that person climbs up the ladder, they’ll make more and more. Let’s imagine they are just incredible at their job. They are in marketing and they are crushing it; they get promoted to overseeing a marketing team and before long they are the VP of marketing.

And let’s say their salary during this time has trippled - they’re making $180,000 per year with a $20,000 bonus. That’s great! But around this point they’re going to start hitting the cap of what they can make in a salaried position. The ownership or company board isn’t going to let that person exceed a certain amount for the health of the company.

- Starbucks barista

- Grocery store clerk

- Elementary school teacher

- Executive assistant

- Pilot

2. Commission ($2k/year - $300k/year)

The next level up, with slightly higher risk and slightly higher income is commission. Commission is when part of all of an employee’s income is based on a percentage of their sales or contribution. The risk is higher because if the employee doesn’t perform, that income is not guarunteed, but the reward is higher as well for high-caliber contributors.

Imagine an IT company that sells hardware to companies. The company has a team of salespeople that have the following commission structure:

| Sales | Commission Rate |

| First $1m in sales | 5% |

| $1m - $4m in sales | 6% |

| $4m and beyond in sales | 7% |

Julie is a new employee - she’s hard working, driven, and an incredible salesperson. She steps in and her first year she sells $1.5m, earning for herself $90,000.

| Sales | Commission Rate | Julie Earned |

| First $1m in sales | 5% | $50,000 ($1m * 5%) |

| $1m - $3m in sales | 6% | $40,000 ($500k * 6%) |

| $3m and beyond in sales | 7% | $0 |

| Total | $170,000 |

Her second year, she does even better, selling $3m and earning $170,000.

| Sales | Commission Rate | Julie Earned |

| First $1m in sales | 5% | $50,000 ($1m * 5%) |

| $1m - $3m in sales | 6% | $120,000 ($2m * 6%) |

| $3m and beyond in sales | 7% | |

| Total | $170,000 |

And the third year, she takes things to a whole new level, selling $5m in product and earning $310,000.

| Sales | Commission Rate | Julie Earned |

| First $1m in sales | 5% | $50,000 ($1m * 5%) |

| $1m - $3m in sales | 6% | $120,000 ($2m * 6%) |

| $3m and beyond in sales | 7% | $140,000 ($2m * 7%) |

| Total | $310,000 |

At this point, the leadership is going to notice the high pricetag they are paying for Julie’s work. They know that they could replace Julie with two or three salespeople who collectively would be less expensive than Julie’s high commission.

- Real estate agents

- Furniture sales

- Auto sales

- Insurance agents

- Financial advisors

- Recruiters

3. Contract Work ($30k/year - $400k/year)

Next up is contract work. Contract work is when you go out on your own, acting as your own business - you might be doing web design work, business consulting, driving for Uber, or taking on graphic design projects.

Sam is a designer who does great work. All the best companies from around the country reach out to him for their logo and UX work. When Sam started, he charged $30/hour for his work but now he’s up to charging $300/hour.

He’s pulling in around $370k per year but certainly feels the risk as well. He knows that bad publicity, reviews, or a downturn in the economy could radically impact his pipeline of client work. He also knows that if he goes much higher than $300/hour, even his best clients are going to start to rethink using his services.

While higher, there’s a natural cap to contract work and certainly a lot more risk.

- Writer

- Web designer

- Graphic design

- Business consultant

- Computer programmer

- Photographer

- Construction worker

- Legal counsel

4. Stock Options ($0 - Uncapped)

Stock options are a big jump in the risk/reward chart as they are the first truly uncapped wealth creation method.

Stock options may be given to an employee as part of their compensation package and can be especially valuable when you get them early on or before a massive season of growth.

Kevin joins a medical startup as employee number 7. As part of his compensation package, he’s given 10,000 of stock options valued at $0.10 a share. Over the next five years, the company does incredibly well, with hospitals and independent practices quickly adopting the solution Kevin’s startup is providing.

The company’s stock grows to $50.10, a 500x growth. Kevin’s options are now worth $500,000. And if the company doubles again, they are worth $1,000,000.

And unlike the first three methods, no one in the company is applying downward pressure on this number. It’s free to grow as high as the market will allow. That comes with risk though as well. There’s no guaruntee they will grow. They might be worth nothing. The odds on this lottery ticket are often against you.

- Joining a startup that includes stock options in the compensation

- Employee Stock Option Plans (ESOPs) where employees can buy stock options

- Executive compensation can include stock options to make the package more attractive and align incentives

5. Royalties (uncapped)

Earning money through royalties is when someone creates some sort of intelectual property (IP) that can be resold (i.e. licensed to other companies) again and again. We see this when McDonalds buys the right to sell Star Wars action figures in their happy meals or when Spotify pays Taylor Swift to play “Love Story” for the nine-hundred-billionth time.

Especially when it comes to royalties, the money is all in the top performers. It follows a power law distribution.

This means it is really tough to break into, as it’s far more likely you’ll fall into the bottom 95%. But if you do break into this space, there’s a lot of money to be made.

While pop culture comes to mind with royalties (e.g. Marvel, Star Wars, Taylor Swift), a slightly easier market to break into is finding interest within a certain niche to license something specific for that industry. For example someone might hold the patent on how to make a certain variation of ice cream and they license that patent out to ice cream shops.

- Google licensing the Android operating system to smartphone manufacturers

- Disney licensing its characters to be used on a T-shirt

- Harry Potter licensing its brand to be used at Universal Studios

- Star Wars licensing its brand to be used by Lego

- Qualcomm holds patents related to mobile phone connectivity (3G, 4G, 5G) and licenses that technology to smartphone manufacturers.

6. Business Brokers (uncapped)

While this category can feel a bit nebulus, people who are able to bring companies together either by purchasing them both or assisting in purchasing them both, can create tremendous value in the world. They see where 1 + 1 = 3 and make it happen.

As an example, some of the DeVos family in Grand Rapids, MI, loves the water. They have purchased companies associated with boating and as a result, can ideally fit the pieces together to create a stronger company due to partnerships with other companies.

Similarly, Marcus Lemonis from the reality-TV show “The Profit” highlights how he purchases complementary businesses. When he owns the graphic design studio, his other companies are able to use that studio and he’s simply paying himself from one business to another instead of that money going out the door.

Partnerships can exist outside of a company being purchased. For example an event planner may develop strategic partnerships with complimentary businesses such as catering, decorators, and DJs. As a result, the event planner can offer a more comprehensive set of services by sub-contracting out some of the work to other companies and charging a premium to the customer.

- The Blackstone Group is a private equity firm which buys companies and helps improve their operational excellence

- Richard Branson buying companies and putting the "Virgin" brand on them

- Google acquiring Android in 2005 to bring its product into the mobile market

- A restaraunt owner purchasing a juice bar and rebranding it with the restaraunt brand to drive more traffic

7. Founders (uncapped)

The top-rung of wealth creation potential is the founder. The founder is the person who sees what doesn’t yet exist, builds it, and introduces it to the world. And while startup statistics speak for themselves on how risky this is, when a founder hits an idea that the world truly needs, it has the potential to create massive wealth.

The other six strategies are all dependent and supported by this category. Employees and contractors work in companies that are founded. Stock options represent ownership in companies. Royalties need companies to use them and business brokers are about putting companies together like puzzle pieces.

But without the founder, who creates a company to begin with, none of the others would be possible. And when done well in the right sector, the profits these companies create are abundant.

- Steve Jobs bringing the iPhone into the world created massive wealth for Apple

- Jeff Bezos figured out online retail and created the giant Amazon

- Ingvar Kamprad developed a mail-order sales business that became IKEA

- Walt and Roy Disney released the Mickey Mouse character, rocketing them on the path to what we know as the Walt Disney Company today

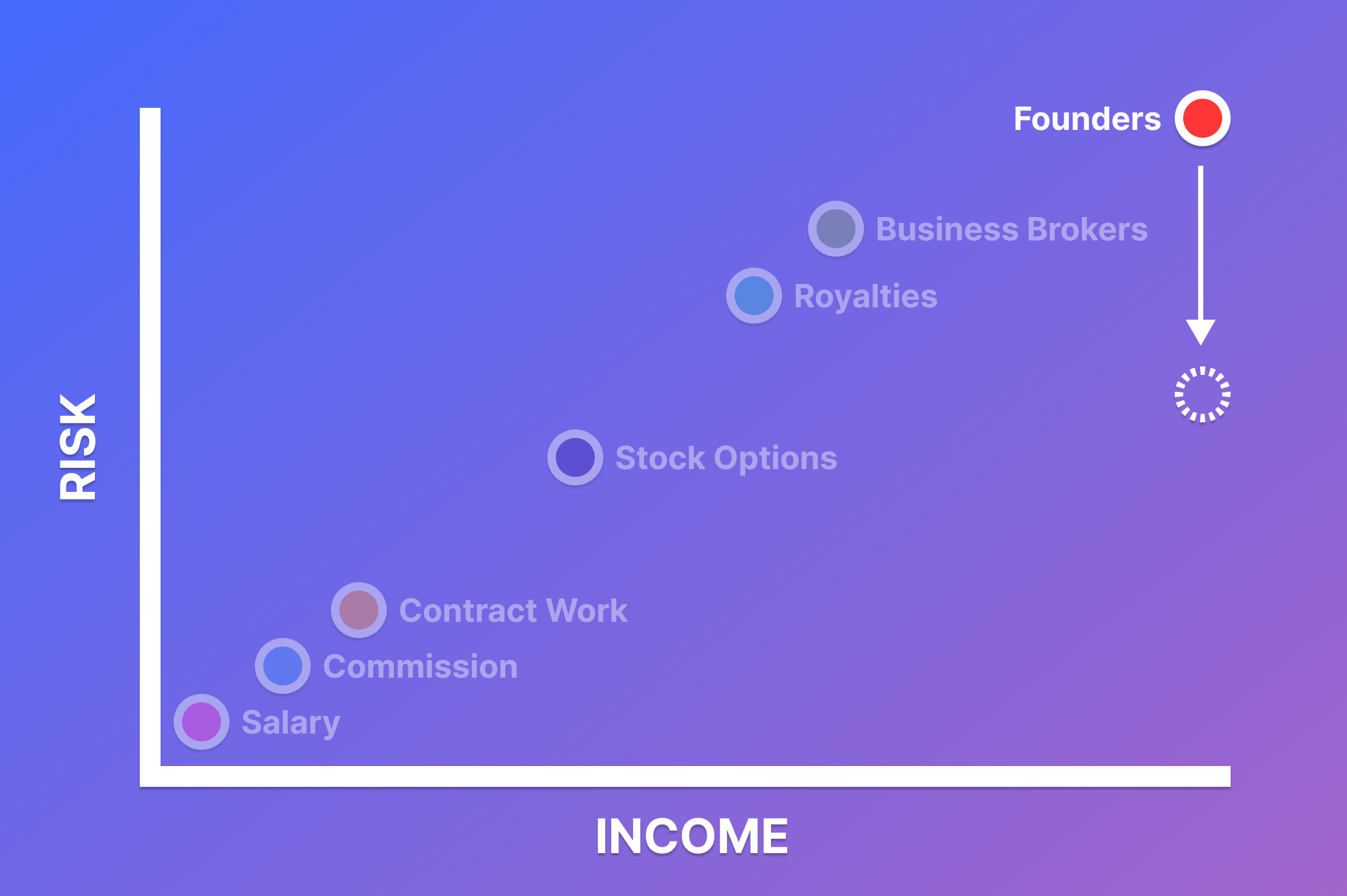

De-risking Founders

Being a founder will always be a risky endeavor. However, with the proper tools and mindset, founders can radically de-risk their endeavors. This is one of my big goals as I work with those interested in entreprenuership.

Founders can ensure they have an audience to sell to, pick a niche where they can get traction, and be passionately focused and clear about the problem they want to solve.

Founders can ask good questions, build their prototype quickly to get fast feedback, and launch a minimal first version of the product to get early feedback.

When founders follow a model that allows them to think strategically about working on their business, not just in their business, it significantly decreases risk, allowing them a better shot at creating something the world needs.